Daily Compound Interest Calculator Forex

Forex Compounding Computer is the Forex trading tool that calculates the profit of next trade with profit added from previous trade to the initial account residue. At the end you get exponential returns on initial investment.

Contents

- 1 What is Compounding in Forex

- ane.ane 2nd Trade With Compounding

- 1.2 Third Trade with Compounding

- two Forex Compounding Rules

- 3 How To Use the Forex Compound Calculator

- iii.one Forex Compound Initial Investment

- 3.2 Forex Compounding Adding Pct of Turn a profit

- 3.3 Compounding Adding per Time Period

- iv What is a Forex Compounding Calculator

- 4.1 Forex Compounding Calculation

- v Importance of a Forex Compounding Calculator

- v.1 Linear Calculation

- 5.2 Compounding Calculation

- 6 Compounding Plan Strategy

- 7 What is the Main Disadvantage of Chemical compound in Forex

- 8 What are Pros of Compounding in Forex

- ix What is the Best Compounding Frequency

- 9.1 Which is Meliorate Compounded Daily or Annually?

- 9.2 Is it Amend to Compound Monthly or Annually?

- ix.three What's Ameliorate Compounded Monthly or Daily

- nine.four What'due south Better Compounded Weekly or Daily

- 10 FAQ

- 10.1 Compound Interest is the Eighth Wonder of the World

- 10.2 Compound Result Graph

- 10.3 How to Compound Money Fast

- 10.4 A Penny a Solar day Compounded for a Twelvemonth

- 10.5 Does Compound Involvement Work in Forex

- ten.6 How practice You Become a Millionaire With Compound Interest

- 10.7 How do Yous Find the Chemical compound Frequency

What is Compounding in Forex

Forex compounding is the process ofusing the turn a profit you lot make on one trade and adding it to your initial account toincrease the profit on the second merchandise.

That means if yous open one trade on a $x 000 account balance and that trade is a successful trade you will brand $200 which is 2%.

2% of $10 000 = $200

Hither is a more detailed explanation.

In Forex you trade Forex currency pairs like EUR/USD currency pairs, where you predict the price of EUR/USD moves up or downwardly on the chart.

That means if the

EUR/USD = ane.1234

the price can move upwardly to

EUR/USD = ane.1235

or downwards to

EUR/USD = 1.1233

And when you brand the correct conclusion you make money. The amount of coin you make on that trade should exist defined in percentage.

In our example above I have used 2% of profit on each trade.

So, at the end I have $ten 200 in my trading account.

To compound this amount I will employ $ten 200 as starting balance on my 2nd trade instead of $10 000 which was the starting residual for the first merchandise.

Second Merchandise With Compounding

At present I have $10 200 as a starting balance. And if I plan to make ii% on the next trade I will brand

2% of $10 200 = $204

Yous can see that my turn a profit increases on the second trade because the starting business relationship residuum is larger.

And if the second trade is successful I will accept

$10 200 + $204 = $10 404

Yous tin can see that in two trades I have taken with compounding I will take 4.iv% with 2% on each trade.

It is not $x 400 which is iv% because I have used my turn a profit on the first trade and included it in the starting business relationship balance.

This is a compounding outcome that increases initial business relationship balance which increases profit on the second merchandise.

Here is a summary afterward 2 trades so we can move to the 3rd trade.

1st trade 2% of $10 000 = $10 200

2nd trade ii% of $10 200 = $10 404

Tertiary Trade with Compounding

At present I have $x 404 as account balance and the trade with 2% of profit will requite me:

2% of $10 404 = $208,08

And when I add that amount to the total business relationship rest I have:

$10 404 + $208,08 = $10 612,08

After three trades I accept $612,08 of profit which is6,12% increment in turn a profit.

Now, let me explicate the math behind the compounding.

Forex Compounding Rules

To get the above results at that place are few rules you lot demand to have in mind or yous will not get the results yous see in above or in the Forex compounding calculator.

- rule – Always use the same percentage of profit on each trade. If you use 1% and then always use ane% on trades you open

- rule – Each trade you open up should be positive if you calculate compounding for each merchandise. If you utilise a time period instead of trade then you need to be profitable in that time period. That period can be twenty-four hour period, week or month.

- dominion – each profit of the previous period should be added to the account balance and calculate per centum gain from that account balance and not from initial account balance. If you started with $ten 000 then the adjacent period volition include profit + initial balance for calculation

How To Use the Forex Chemical compound Calculator

Use Forex calculator chemical compound by inbound iii important variables in the estimator and those are:

1st variable – initial investment

2d variable – percentage of turn a profit

3rd variable – fourth dimension period

Enter these three variables in the Forex computer compound and click on the push button "Calculate".

You will go the results in the table where you tin can see how much you would get afterward each fourth dimension menses.

Forex Chemical compound Initial Investment

With initial investment y'all define what will be the starting account balance the Forex calculator chemical compound will get-go the calculation.

This initial investment will be increased in each time period with previous period profit. And that increased investment will be used in time to come calculations.

Have in heed that Forex calculator compound works with turn a profit only. If you lot lose money in 1 time menstruation the table with results volition non exist valid.

You will need to enter a new account balance as a starting investment and make the calculation again.

The Forex compounding calculator expects that y'all increase the investment each time flow.

That means, if you start with $ten 000 and you apply a monthly time period, y'all demand to make money that month. Non to lose the money.

So, you lot demand to make at least the percentage you have defined. If that is 2% and so you demand to take $x 200 at the end of the get-go menstruation.

If you make less, for example $ten 100, which is 1% and then you demand to make the calculation again with the Forex compound calculator.

And and then you will have $10 100 equally initial investment.

Forex Compounding Calculation Percentage of Turn a profit

The second variable you need to define is the percentage you volition make per each period. That tin can be 1%, 2% or whatever other percentage.

But, that means percentage of profit of account balance.

In my example I have used $10 000 as initial balance or initial investment. And I take opened three trades.

Those three trades can be in a day or in a calendar week.

Compounding Adding per Time Period

Lets employ month as a fourth dimension period because monthly period is mostly used in calculating profits. Usually all traders want to see how they have traded when the month ends.

So, the time catamenia is a calendar month.

You select the percentage of profit in a month. That can be 1% per month or 2% per month or whatever other per centum as I accept already mentioned.

What is a Forex Compounding Calculator

Forex Compounding Calculator is thetool thatcalculates theturn a profit of next trade withprofit added from previous trade to the initial business relationship balance.

The formula backside the compounding computer is here.

A = P(ane+r)t

- Principal or Initial residual (P) = 10 000

- Per centum or Rate every bit decimal (r) = ii/100 = 0.02

- Time period (t) = 3

Fourth dimension period can exist solar day, week, month or any other period you want to calculate compounding results.

Allow me prove this formula on example from above where I had $ten 000 equally initial balance so

P = 10 000

and 2% of profit on each trade then

r = 0.02

Time menstruation will be the number of trades. In my instance I had 3 trades so

t = three

Forex Compounding Calculation

Let me testify

A = P(ane+r)t

A = 10 000 (1 + 0.02)3

A = 10 000 (1.02)three

A = 10 000 (1,061208)

A = 10 612,08

Now, when I make each trade separately you volition see how I have got the above consequence.

Hither is the pace by step of the Forex calculator compound with the compounding rules I have mentioned in a higher place.

Rules:

- dominion – Ever use the same pct

- rule – Each trade you lot open should be positive

- rule – each turn a profit of the previous period should be added to the account balance

one.st trade with 2% of $ten 000

A = P(1+r)t

A = x 000 (1 + 0.02)1

A = 10 000 (one.02)i

A = x 000 (1.02)

A = 10 200

2.nd merchandise with two% of $10 200

A = P(1+r)t

A = 10 200 (1 + 0.02)1

A = 10 200 (1.02)ane

A = 10 200 (1.02)

A = 10 404

3.rd trade with 2% of $10 404

A = P(ane+r)t

A = 10 404 (one + 0.02)one

A = ten 404 (1.02)1

A = 10 404 (ane.02)

A = 10 612.08

Importance of a Forex Compounding Calculator

As you can run across when yous add together the profit of previous trade to the calculation for the next trade you lot increase the profit on the next trade.

And you lot utilise the same per centum of profit. If that is ii% it stays the aforementioned all the time, but the profit increases.

Compounding in Forex increases the account balance then that is why information technology is important to utilize it in Forex trading.

If yous take a expect how the compounding in Forex looks for college time periods so you volition see that compounding in time gives yous huge returns.

And by huge I do not mean linear increase like this beneath where I have used xxx trades with 2% turn a profit adding.

Linear Calculation

You lot tin can see how of import compounding in Forex is when you apply linear and compounding calculation.

In 30 trades, or 30 day or 30 months, you define which time flow y'all want to use, you can encounter how the amount volition change.

Linear calculation gives you lot an increase in profit of $6000. So, if you employ the 30 months period you will make $six 000 on a $10 000 investment.

30 periods = $6 000 on $10 000 investment

Compounding Calculation

When you use same conditions as with linear adding and that is ii% of turn a profit, $10 000 initial investment and 30 month fourth dimension menses yous get this:

30 periods = $18 113,62 on $ten 000 investment

You can see how important compounding calculation is in Forex trading. Information technology gives you huge returns which you could non get with linear investment.

Compounding Plan Strategy

Strategy should include these steps:

Step #i – cull currency pair for trading

Pace #2 – define lot size you will employ

Footstep #3 – ascertain stop loss and take profit levels

Step #4 – define take a chance per each trade, Chance:Reward

Step #5 – define time period yous will use in Forex compounding plan

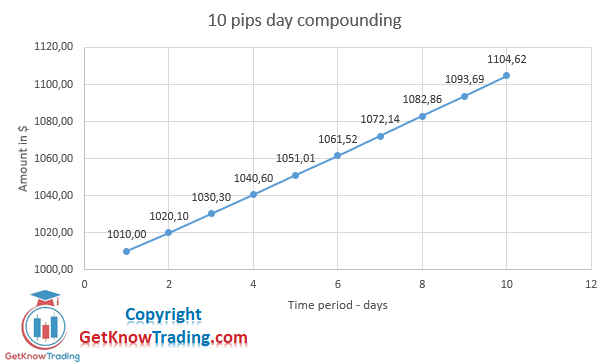

Below is the graph what would you brand if you utilise ten pips risk per each trade daily.

To reach that you would demand to use Forex trading program and for that I have fabricated an article that volition show you Forex compounding plan to achieve that.

What is the Chief Disadvantage of Compound in Forex

Principal disadvantage of compound involvement in Forex is that information technology is difficult to have a constant percentage of profit in a certain time flow.

Is information technology not piece of cake to find a strategy that will give you profit each calendar month with a guaranteed per centum. If that is easy and then all of usa would be rich with Forex trading.

And for example, if you have a time menstruum of a month with two% target you would need to open at least i merchandise that would bring you 2% of turn a profit.

That would look similar this:

1 trade with two% of $10 000 = $200

If you open up two trades so both trades would demand to be positive or at least ane positive and second merchandise without loss.

That would look like this:

1st merchandise – 2% of $10 000 = $200

2d trade – ii% of $10 000 = $200

Full = 4% of $10 000 = $400

In 2d instance when one trade is positive with two% of profit and 2d one is without loss:

1st trade – 2% of $10 000 = $200

second trade – trade exited at the same price you accept entered. So there is no loss

TOTAL = ii% + 0% = 2% of $10 000 = $200

But, if information technology happens that yous open up ii trades and i is positive and second one is negative you would end upwardly with:

1st merchandise – two% of $10 000 = $200

2nd trade – -2% of $x 000 = -$200

Full = 2% – ii% = 0% of $10 000 = $0

Ane affair to note hither is that you demand to pay attending not to lose on each merchandise more than than you will gain per trade. That means the risk you will calculate in the trade with ane% of profit cannot be more than 1%. If you take Risk:Reward ratio 1:1 or 1:2 y'all could end up at zero at the end.

But, if yous useRisk:Advantage = one:0,5 then you would lose more per trade than y'all would brand when the trade is positive. This is a bad trading conclusion so I would not propose going into Forex trading every bit a beginner withRisk:Reward less than 1:ii.

What are Pros of Compounding in Forex

The main advantage or pros for Forex compounding is the result of the investment after a sure menses where you make more afterward each month with the aforementioned pct.

In the example from the graph higher up you tin can encounter that each month with the same percent of profit you lot end upwardly making more.

For example allow's take the profit y'all make with 2% afterwards the kickoff month with your initial $ten 000 investment.

2% of $x 000 = $200

And lets take the profit with ii% subsequently the 5th month with the account balance after four months.

2% of $10 824,32 = $216,49

You see, subsequently making $200 after the first month you will brand $216,49 after the fifth month. That is a difference of $16,49 without whatever changes.

$216,49 – $200 = $16,49

But only using compounding calculators in your trading.

What is the Best Compounding Frequency

The best compounding frequency isweekly frequency that gives you4 times more than monthly frequency.

Simply, the all-time compounding frequency depends on the trading results you tin achieve. If you have a good trading strategy with skillful results then you tin make a lot of coin chop-chop.

Let's put numbers on the table to explain to you lot which compounding frequency is the best.

I will assume I can get i% per each trade I open up. And that means I do non take whatever bad trades.

To give yous a rough overview of how that would expect on a weekly footing check this out. If I open 1 merchandise per mean solar day throughout the week I will make v%.

Mon – ane%

Tuesday – i%

Wednesday- 1%

Thursday – 1%

Friday – one%

Now, If I take the same results for four weeks per calendar month I would end upwardly with iv% at the cease of the calendar month.

4 10 1%/week = four%

And when I have aforementioned scenario and put it on a monthly footing I would go this:

one x 1%/month = ane%

Hither is a table that shows y'all what I hateful by having dissimilar compounding frequencies.

The table higher up shows you lot three dissimilar compounding frequencies.

Daily compounding frequency – each twenty-four hour period you lot make ane% and next day add this amount to initial residue

Weekly compounding frequency– each week you make ane% and next week add together this amount to initial balance

Monthly compounding frequency – each calendar month you brand ane% and next calendar month add this corporeality to initial balance

Annual compounding frequency – each twelvemonth you make 1% and side by side twelvemonth add this amount to initial balance

In the kickoff column, which is the daily compounding frequency, you have the amount of coin afterward the showtime month. Each row represents one calendar month.

That way y'all can see where the difference is between how much money yous tin can make each month if you compound with daily, weekly or monthly frequency.

Second cavalcade shows you weekly compounding frequency and the corporeality of money you will have at the finish of that month.

Tertiary column shows you monthly compounding frequency and how much money you would have at the end of that month.

Fifth column where the annual compounding frequency is shows y'all one yr with 1% of turn a profit. Information technology is a small amount just it is a very conservative approach with conservative return.

Which is Better Compounded Daily or Annually?

By simply checking the terminate of the year yous can meet that you would make more than thou% if y'all have daily compounding frequency compared.

$108.925,54 is >1000% of profit

So, you come across that annually compounding results would give you lot only 1% render on $10 000 investment.

$x.100,00 is ane% of profit

Then, if you tin can, the all-time is to have daily compounding frequency. But is that actually possible?

Can you make 1% of profit without having a bad twenty-four hour period? Hard, but non impossible.

Is information technology Better to Compound Monthly or Annually?

Now, if you lot compare monthly return with almanac return you see that monthly return has more than ten% of render and annually has only one%.

$11.268,25 is >x% of profit

Compared to annually render

$10.100,00 is 1% of profit

I can say for certain that I would like to have a monthly render more than than annually. And I can say that monthly returns are possible to reach if you take a practiced trading strategy.

What'southward Improve Compounded Monthly or Daily

Monthly or daily compounding shows you that daily compounding is better than monthly with more than twenty% of profit at the end of the first month.

$12.201,xc is >20% of profit

And for the showtime month y'all would make but 1%

$10.100,00 is 1% of profit

Just, if we compare daily compounding with monthly compounding at the end of the year we get this for daily compounding

$108.925.54 is >1000% of profit

and we get this for monthly compounding

$xi.268,25 is >ten% of profit

You lot can see thatdaily compounding has more1000% of turn a profit compared to more thanx% of profit onmonthly compounding.

What's Meliorate Compounded Weekly or Daily

Let's compare weekly compounding and daily compounding.

At the end of the beginning month we would accept 4% of render on weekly compounding

$10.406,04 is >four% of profit

If we bank check daily compounding at the finish of the first month nosotros get

$12.201,90 is >20% of turn a profit

So, thedaily compounding with>20% of turn a profit is improve thanweekly compounding with>4% of profit at the stop of the first month.

FAQ

Compound Involvement is the Eighth Wonder of the World

Compound interest is the eight wonders of the globe with exponential render where y'all reinvest what you have earned.

No wonder why Albert Einstein said that at that place are eight wonders of the globe.

When you lot meet what yous can reach with a compound growth calculator then the sky'southward the limit.

Compound Upshot Graph

The all-time compound consequence graph is the one beneath where you tin can see how three different compounding effects have dissimilar results.

Y'all tin can see a one% compounding result graph which is shown with a grayness line at the lesser.

And then you have a 5% compounding effect graph with a brownish line in the middle.

And a ten% compounding effect graph as a blueish line on the upper side.

You can run into that the higher pct compounding effect starts to increment exponentially earlier than the lower pct compounding effect.

How to Compound Money Fast

Compound money fast by increasing the percentage return to have at to the lowest degree x% or more than. College compounding percent render will requite y'all quicker exponential return.

Second thing you need to practise to compound money fast is to utilise a shorter fourth dimension menstruation. Time menstruation defines how fast y'all volition use per centum growth.

Volition that be on each trade or will yous use daily compounding effects?

If you utilise compounding growth calculators on each merchandise then you can take several trades per solar day and after each trade yous can grow your account.

Check the graph below where I take set the pct render to 50% and time menstruum as a day.

That means you trade ten days with $1000 invested and each day you make 50%.

A Penny a Day Compounded for a Year

If y'all ever wonder how a penny a day compounded for a year then hither is the graph that shows y'all the result.

1% – $0,378

2% – $13,77

3% – $484,83

4% – $16.488,03

5% – $542.118,42

A penny a twenty-four hour period compounded for a year with five% return per day would give yous $542.118,42. Half a million with a penny per day in a year.

Does Compound Interest Work in Forex

Compound interest works in forex by adding each time catamenia return to initial investment to grow the account balance exponentially.

Y'all could see that unlike time periods and percentages in compounding calculations give different results.

Below is the tabular array with dissimilar results on $10 000 investment.

Yous can utilize different compounding frequencies and run into how compound interest works in Forex trading.

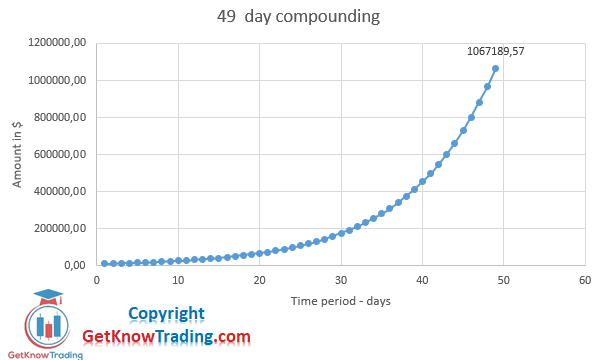

How exercise You lot Become a Millionaire With Compound Interest

You become a millionaire with compound involvement by investing $10 000 and make 10% each twenty-four hour period through 49 days.

Hither is how that would look.

Y'all would invest 10% each solar day and add that return to initial investment. After 49 days you would have:

49 days with 10% compounded = $i.067.189,57

This approach would make y'all a millionaire with compound interest.

How do You Notice the Compound Frequency

To observe the compounding frequency you demand to employ the CAGR formula which is compound annual growth rate or compound growth calculator.

ROI(CAGR) = ((Ev / Bv)1/n– 1)*100

Ev – catastrophe value

Bv – beginning value

north – number of time periods

The CAGR is a reverse procedure compared to compounding calculators where you search for compounding frequency later y'all have initial investment and end balance afterwards a certain time menses.

Here is an article where you tin can find more than details nearlyCAGR formula in excel.

"Disclosure: Some of the links in this post are "chapter links." This means if yous click on the link and purchase the item, I will receive an affiliate committee.This does not cost you anything actress on the usual cost of the product, and may sometimes cost less equally I accept some chapter discounts in place I can offering you"

A Forex trader since 2009. I like to share my knowledge and I like to analyze the markets. My goal is to have a website which will be the commencement choice for traders and beginners. Market place analysis is featured past Forex Factory next to big publications similar DailyFX, Bloomberg... GetKnowTrading is becoming recognized among traders equally a website with simple and effective market assay.

Daily Compound Interest Calculator Forex,

Source: https://www.getknowtrading.com/forex-compound-calculator/

Posted by: foxpenated.blogspot.com

0 Response to "Daily Compound Interest Calculator Forex"

Post a Comment