open interest option trading strategy

Bydannbsp;Varun Divakar

Bydannbsp;Varun Divakar

What Is Unsealed Worry In Options Trading?

Open matter to is a very good indicator of the investor activity in a stock/index. In line to the daily book whose increase Oregon decrease is not directly correlated to the strength of the move, the open interest is a direct measure of the strength of the draw in a grocery. To explain far, if a rally in the price of a stock is connected with an increase in open interest then you canful be certain that inexperienced positions have been added or that there is a renewed interest in the stock/index. This is an indicant that nates easily embody used in Futures and Basics of options trading. Today let us try to build an Open Interest Trading Using Python to check some basic assumptions virtually what open interest indicates. This blog is an introduciton to option trading for dummies.

Where To Find Open Interest Information?

For the first time, let us pull the data of a stemm/index and verify the open interest from this open interest data. Let us rend the futures price of the stock SBI (State Bank of India) and check the trend in its price and afford interest. It is standard for a stock to increase its open interest when the sign on becomes active or front calendar month. Conversely, as the well-worn approaches expiry its open interest decreases. So, to check if the open interest of the futures is maximising or decreasing, we will have to take the combined open interest of the front and second-month futures contracts. This wish generate you the complete picture and avoid any abnormality during the contract rollover.

Options Trading Victimization Open Interest

In this blog, I will show you how to side the futures data of the Jan sign, after IT became the front month, and so we will deplume the close calendar month sign (February) information for the same metre period and see for the combined wide worry. I have used the package nsepy (Thanks to Swapnil Jariwala for sharing the code) to draw in the data of NSE stocks.

Pull The Information

from nsepy import get_history from datetime import date spell pandas as pd import matplotlib.pyplot as plt shopworn="SBIN" start=start=date(2017,12,26) end=date(2018,1,25) end2=date(2018,2,5) data_fut = get_history(symbol=stock,futures=True,start=start, cease=end, expiry_date=date(2018,1,25)) data_fut2 = get_history(symbolisation=stock,futures=True,start=start, finish=end2, expiry_date=particular date(2018,2,22))

Let U.S. print and bank check some contracts' data.

data_fut contains the futures data of Jan narrow down and data_fut2 contains the futures information of Feb contract. Straight off, let us combine the open interests of both the contracts and plot the change.

data_fut contains the futures data of Jan narrow down and data_fut2 contains the futures information of Feb contract. Straight off, let us combine the open interests of both the contracts and plot the change.

OI_combined= pd.concat([data_fut2['Open Interest'],data_fut['Open Interest']], axis=1) OI_combined['OI_Combined']=OI_combined.sum(axis of rotation=1)

Plot The Data

plt.figure(1,figsize=(10,9)) plt.subplot(211) plt.title('Open Interest') plt.plot(OI_combined.OI_Combined,label='OI') plt.plot(OI_combined.OI_Combined.rolling(5).hateful(),label='OI') plt.caption(['OI','OI_mean'])  Next, we ready a continuous narrow that rolls over afterwards death and check the stock's execution for the same time period.

Next, we ready a continuous narrow that rolls over afterwards death and check the stock's execution for the same time period.

C_combined= pd.concat([data_fut2['At hand'],data_fut['Close']],axis vertebra=1) C_combined['Continous_Close']=C_combined.iloc[:,1].fillna(C_combined.iloc[:,0])

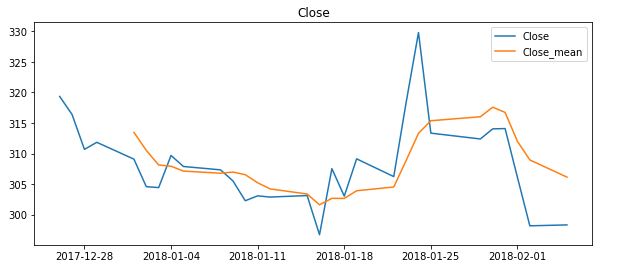

plt.subplot(212) plt.title('Close') plt.secret plan(C_combined.Continous_Close) plt.plot(C_combined.Continous_Close.peal(5).hateful()) plt.legend(['Juxtaposed','Close_mean']) plt.evidenc()  American Samoa you can see, I feature combined both the futures contracts with the unaired prices of the Jan contract until its expiry and later with February's contracts.

American Samoa you can see, I feature combined both the futures contracts with the unaired prices of the Jan contract until its expiry and later with February's contracts.

Analyse The Data

Now let us analyse how the stock listed and if there was an opportunity for the States to trade in this combined Clear Interest chart. First, Army of the Righteou us put these two charts together then you toilet see that the combined OI (open interest) starts to decrease well before the expiry, simply the price keeps increasing. This is generally well-advised a pessimistic sign, A it indicates the fact that either of the traders is winding up their positions or beginning to short, and hence the open interest is decreasing. This leaves U.S. with a good shorting point just before the expiry, when the divergence increased significantly. I will leave you with a runty but important table that will help in identifying the strength of a trend.

For the final confirmation rent out us pull the options data for the same stock with the same time period and verify.

data_fut = get_history(symbol=stock,offse=start, end=end,option_type='CE', strike_price=310, expiry_date=date(2018,1,25)) data_fut2 = get_history(symbol=stock,start=start, end=end2,option_type='CE', strike_price=310, expiry_date=date(2018,2,22)) OI_combined= pd.concat([data_fut2['Available Interestingness'],data_fut['Open Stake']], axis=1) plt.figure(1,figsize=(10,9)) plt.subplot(211) plt.title of respect('Yawning Interest') plt.plot(OI_combined.sum(axis=1),label='OI') plt.plot(OI_combined.sum(axis=1).reverberative(5).mean()) C_combined= palladium.concat([data_fut2['Close'],data_fut['Close']],axis=1) C_combined['Continous_Close']=C_combined.iloc[:,1].fillna(C_combined.iloc[:,0]) plt.subplot(212) plt.form of address('Last') plt.secret plan(C_combined.Continous_Close,pronounce='Close') plt.plot(C_combined.Continous_Close.rolling(5).normal()) plt.point()

Conclusion

As you can ensure, the Open Interest of the options contract has also shown a significant reduction before the expiry. This further strengthens our belief that a correction is on the cards.

Disclaimer: All investments and trading in the commonplace grocery involve chance. Any decisions to place trades in the commercial enterprise markets, including trading in stock or options or other financial instruments is a personal conclusion that should solely be ready-made after exhaustive research, including a personal risk and financial judgement and the engagement of professional assist to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes single.

Download Data File

- Open Interest group Trading Python Code

Login to Download

open interest option trading strategy

Source: https://blog.quantinsti.com/open-interest-options-trading-python/

Posted by: foxpenated.blogspot.com

0 Response to "open interest option trading strategy"

Post a Comment